A Complete BookMap Review

There’s a huge industry in creating software for traders and much of it is frankly an expensive waste of time. However, every so often, a software developer comes along and brings something entirely new to the table. Something of genuine intrigue. VeloxPro seem to have done just that. So let’s take a look at it in this complete BookMap review.

Over the past few months, I’ve been fortunate enough to get to grips with this new piece of software that holds real promise to those willing to invest the time and effort required to learn it. BookMap X-Ray is a tool for visualizing the current and historical orderbook – something that day traders have had to do by memory until now.

BookMap X-Ray is a great piece of software, but for those of you who aren’t quite ready to make the leap just yet, I want to run through the features of this still very new software and suggest to you some uses for it.

Great Software Comes From Great Developers

Since I first came across BookMap, I’ve met some of the people from VeloxPro who are behind the software. What this did for me apart from giving me the belief that they are a genuine bunch of decent chaps, was tell me where it all began for them.

Many trading tool developers come from the place they look to serve – day traders develop tools for day trading for example. And this perhaps explains why BookMap offers a unique market perspective.

The background of the team seems to universally be one stemming from the world of HFT. These are the guys who write the sort of algorithms that instruct computers to send order instructions based on predefined rules. They come from part of the trading world where millisecond timeframes are no longer fast enough. Where algos constantly search for liquidity and press direction using limit orders as their tools.

HFT has changed the game for day traders and now, perhaps, some canny software developers from the world of HFT are helping to swing the pendulum back to some extent.

But one good idea doesn’t make a great piece of software does it? Nope. In fact, it can make an infuriatingly useless piece of software which, consistently flatters to deceive. Developers who fail to implement their software properly and fail to listen to the customers they serve, usually end up losing out to someone else who eventually “does it right”.

Having already worked with some of the guys behind BookMap, I’m pretty sure they are the polar opposite of this kind of developer.

The Orderbook X-Rayed

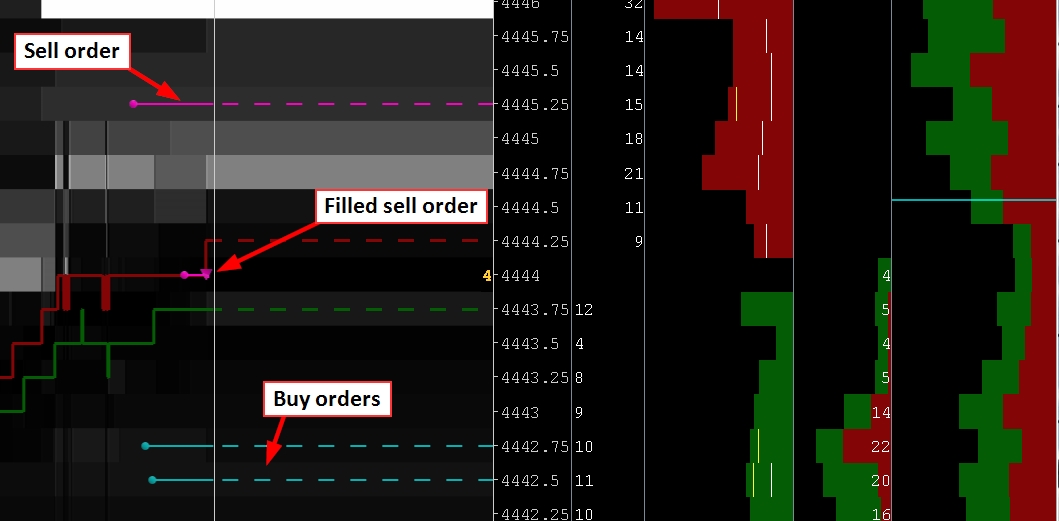

Okay, so I’ve already said that BookMap is a tool for visualizing the current and historical orderbook. But how is that useful? Well, it makes reading market activity and orderflow much simpler.

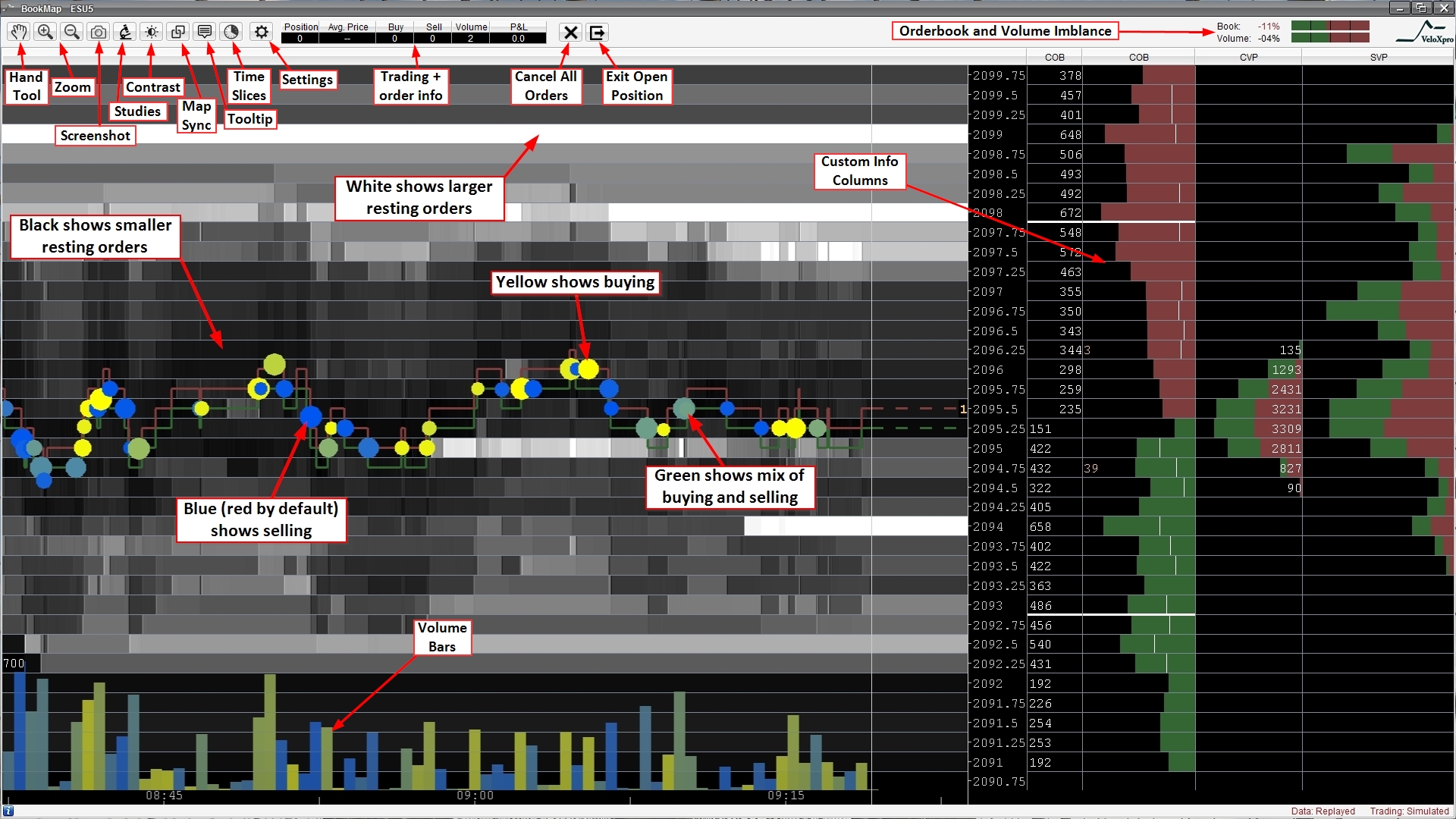

Before we go any further, I really should point out another feature that in my opinion, is absolutely critical to making this software incredibly useful instead of being just another chocolate teapot. The feature I’m referring to is Volume Dots – these are configurable visualizations of trade size and intensity.

Before we go any further, I really should point out another feature that in my opinion, is absolutely critical to making this software incredibly useful instead of being just another chocolate teapot. The feature I’m referring to is Volume Dots – these are configurable visualizations of trade size and intensity.

In reality, it’s this symbiosis of the orderbook heatmap and volume dots, which creates such a powerful visual tool for traders to read and understand trading activity and orderflow. The way BookMap X-Ray translates how the market is set and how it reacts to volume trading at particular prices is invaluable.

Going back to the heatmap itself, it’s the historical element that makes it so powerful. Traditionally, if you wanted to read the DOM or orderbook, you’d have to memorize what was queuing and where at any given time. You’d also need to have a rough idea of what traded there – at least any sizeable trades that went through anyway. Of course, you could look at the tape/time & sales for this, but that’s not exactly an intuitive approach to getting the information you need.

If you had a decent memory and a superb attention span, you might be able to create a kind of mental orderbook heatmap. And whilst that’s certainly possible to do, it takes some time to get decent at it. When it comes down to it though, it’s just not that easy at all.

The thing is, it’s important to realise that there are all kinds of movements in the orderbook happening all the time. So you still need to interpret what the tool is showing you. The information has to be put into the context of what the market has done and what your setups are.

Some Simple Applications to Consider

I can certainly see that there are going to be a lot of people who will love this product. Prop traders to start with (probably why they support TT X-Trader). But there will also be plenty of guys who will think it looks fantastic, but don’t really know what to do with it.

I want to highlight some basic ways of using BookMap, but I’d also point out that there are live webinars that VeloxPro run all the time and plenty of YouTube videos that cover a variety of ideas on how to use it.

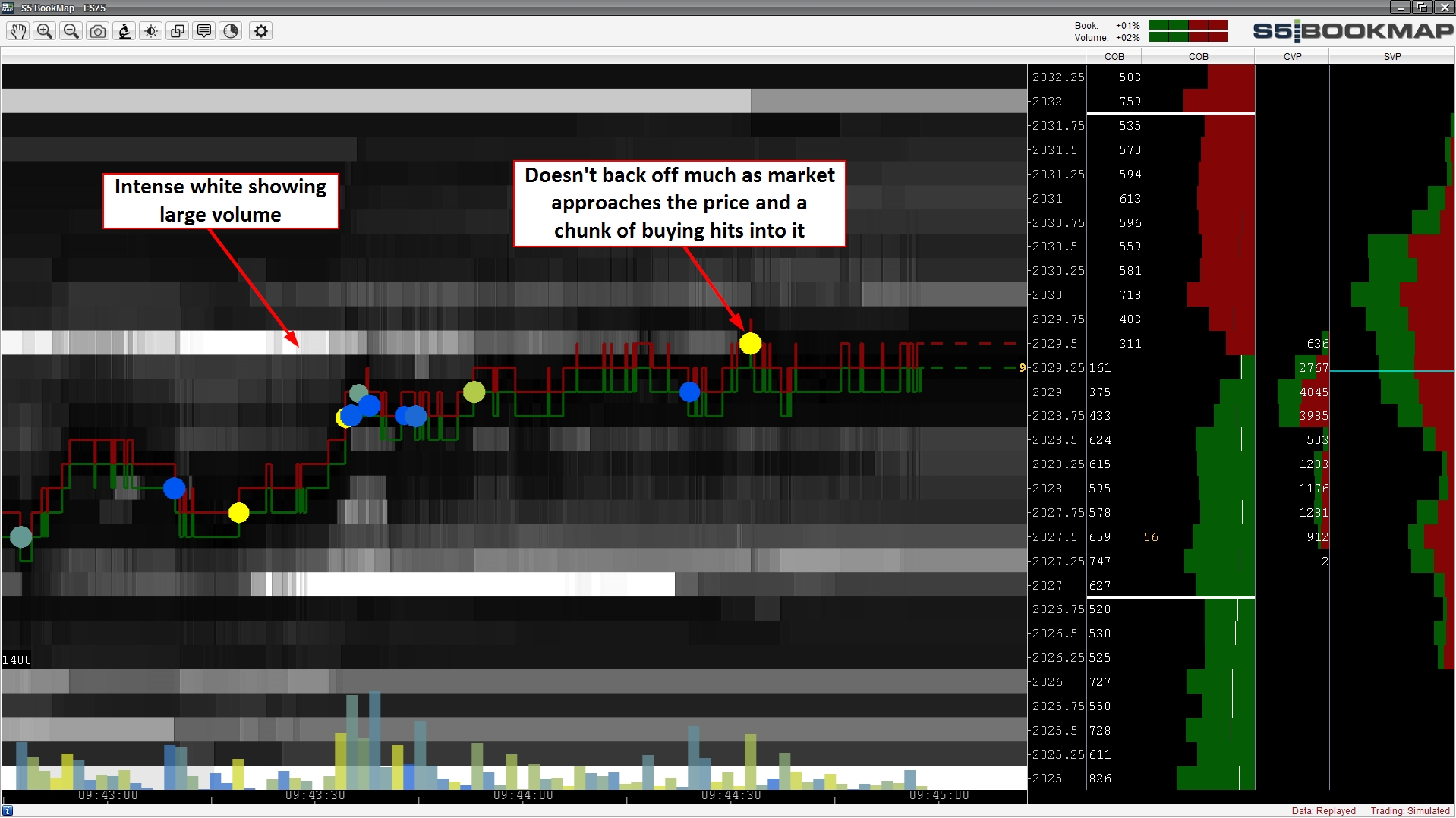

Real volume

The first and perhaps most obvious application is seeing where real volume is and how the market reacts to it. There’s plenty of market making, spread trading and various other activity in the markets that makes you think there’s decent volume interest in the orderbook, yet when the market gets anywhere close to the order, it gets moved and so never actually executes.

Volume that sits there is a different matter though. It shows intent to execute for whatever the reason might be.

Of course, seeing this kind of thing happen at a level that you were already interested in trading, might just give you more confidence to take the trade.

Of course, seeing this kind of thing happen at a level that you were already interested in trading, might just give you more confidence to take the trade.

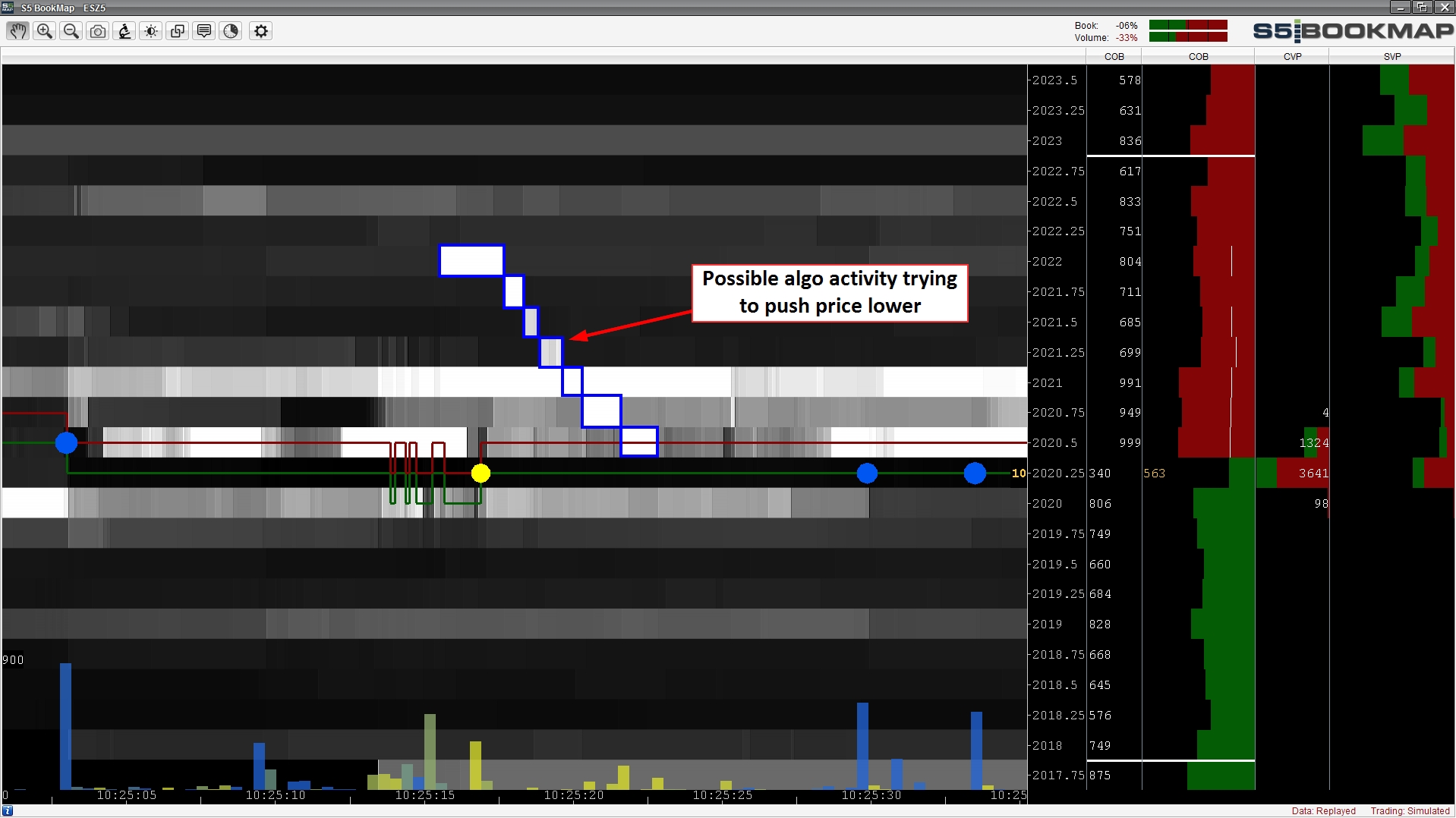

Spotting algos in action

Algos are prevalent in electronic markets – or at least, that’s what we are led to believe. I don’t disagree, although I don’t believe that there are anywhere near the amount of algos making trading decisions without any sort of active human input.

However, BookMap does do a good job of highlighting nefarious activity in the markets, algorithmic or otherwise. Quickly spotting this kind of activity can help you to recognize it for what it really is.

However, BookMap does do a good job of highlighting nefarious activity in the markets, algorithmic or otherwise. Quickly spotting this kind of activity can help you to recognize it for what it really is.

Feel and flow of the market

Seeing how the market is flowing is a great way to judge its current mood. It can, in combination with proper analysis, give you excellent clues to what the market might be trying to do and how it might react to certain prices.

Some might believe that there’s a fantastic indicator out there that’ll give you a reliable read on this, but to me, the feel of the market is far more subjective and when it comes down to it, reading subtle differences is something the human brain is very good at (if you can see it in the first place) – although clearly, not everyone is brilliant at deciding how to act based on this information!

If you’re not convinced of the value of being in sync with the flow of the market, consider it from a different angle. When you’re clearly out of sync with market flow, what does your performance generally look like? Mine personally, isn’t fantastic. BookMap not only helps you stay in sync by its very nature, but it also allows for session recording and playback to go over a session after the fact, if you feel like you’re on the wrong end of every reversal.

Core BookMap Features

For a new piece of software envisioned and built from scratch, BookMap already has a whole host of great features. Here are a few of them that I think you’d potentially find useful.

Historical Orderbook Heatmap

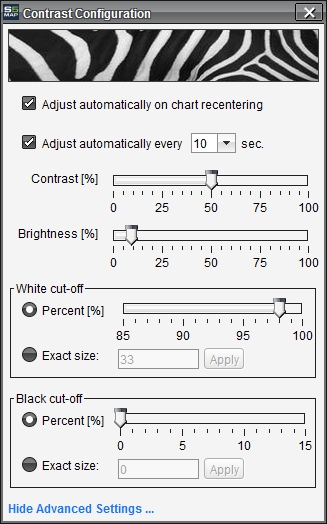

This is the number 1 feature. The heatmap is based on the number of orders on each price at any given moment in time. The intensity automatically updates by default, but like the brightness and contrast, it’s user definable.

It should be noted how the software updates price and the orderbook. It’s not based on new quotes and trades coming in via your datafeed, but rather by time. Each pixel is an amount of time and you can zoom in or out to view smaller or larger amounts of time per pixel (use mouse scroll wheel as a handy shortcut for doing this).

So each pixel is effectively a snapshot of the market data at that point in time.

Because the heatmap intensity is displayed based on the number of orders at any given time, there is a slight inherent weakness in BookMap. If someone places an order of much greater size (but clearly fake) than any other price, the map will fade and the heatmap intensity at all other prices will become useless. You could adjust this so the large size isn’t the benchmark value, but then you’d lose its definition too. Also, in a product where the difference in resting orders over the whole book is much smaller in terms of percentage, you’ll get a display that doesn’t provide you with much definition.

VeloxPro have built in extra features here to make the necessary adjustments, but just be aware that there will be some tweaking required in some situations.

Volume Dots

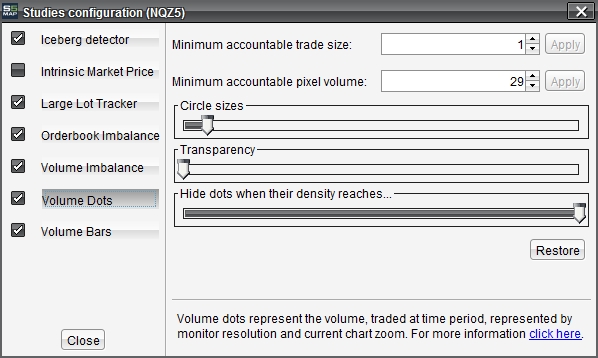

Because of the time-based updating, it’s important to recognize that volume dots are the volume per pixel, not per trade. It’s fairly natural to assume that a discrete dot represents a single trade and it’s a mistake I initially made. This however, is not the case.

Because of this, the price the dot is centred on is based on the VWAP of the pixel’s volume. So a pixel that trades 28 at 2028.75, 12 at 2029.00, 3 at 2029.25 and 4 at 2029.50 will show a price of 2028.91. This becomes far more important the more you are zoomed out where there’s likely to be a greater spread of traded prices within each pixel.

There are a number of settings you can change for the dots. You can filter trade size and dot size separately, meaning there must be a minimum size of a single trade and/or total pixel volume for the dot to show up at all. Great if you’re trying to spot bigger players perhaps…

You can also change the size and transparency of the dots. Finally, you can opt to hide a dot when it reaches a certain density (although I’m not 100% sure of why you’d do this).

The other crucial point to the volume dots is that you can select the buy and sell colours. By default these are set to yellow for buy and red for sell. I’ve changed the sell colour to blue though. The reason for this is that when a dot has a combination of buys and sells, the colours blend and I was finding the various shades of orange not especially distinguishable. Mine changes to different shades of green. But that’s just me and your eyes are almost certainly different to mine – so play with the colour settings and see what works for you.

Differentiation between buy/sell volume dots might be easier with a third colour and/or a different shape entirely – that’s probably one for the roadmap though.

Info column

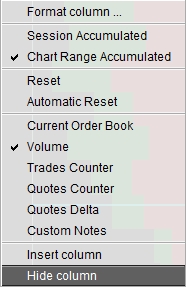

The info columns are designed to be flexible. There are a number of options to show per column and you can choose how many columns you want to display. The options are: – orderbook, volume, trades, quotes, quotes delta, custom notes.

Having the option to add custom notes is something that you might find helpful if you wish to note down particular prices – an NFP high and low for example might be worth adding a note for.

Another possible way of configuring a map is to be zoomed in and display the current volume – this can give you a very nice clue to how the very recent action has developed.

For each item, there’s the ability to show numbers and/or bars, bid/ask/both, split the bid/ask display, choose a custom justification and display data in view/session accumulated/since last user reset.

Trading

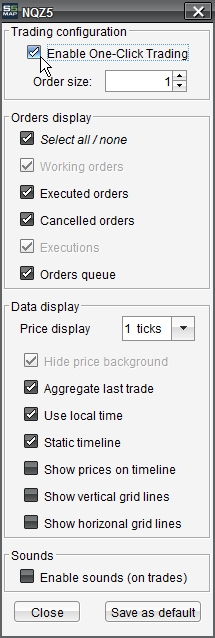

Trading is possible directly from a map (paid add-on). To enable trading you must click on the cog icon at the top of the map, check “Enable One-Click Trading” and then select your default order size.

Clicks to the right of the price line will send orders. A left mouse click will send a buy limit and a right mouse click will send a sell limit. A middle click at a price level will cancel the last order at that price and ctrl + middle mouse button click will cancel all orders at that price. Clicking on the big X at the top of the map next to your P&L will cancel all orders and clicking on the exit icon to the right of that will close an open position.

I’m not a big fan of the way BookMap currently handles trading if I’m being honest. I’m not against it in principle as not having to flick your eyes between various different platforms is definitely something I’d prefer.

Although I don’t think the trading options are particularly well covered (e.g. different order types, dragging to move orders), probably the main reason that I wouldn’t use it is that it still doesn’t have a fixable price scale – meaning at any given point, the price that you thought you were clicking on can move. What I’d like to see is an option to make it move like a normal DOM.

I have been informed that this has been added to product roadmap, but I honestly don’t know when it will be available.

There is one current benefit however. BookMap will link into your trade account and show you where your orders are even if you’ve placed them in S5 Trader for example. So this way, it’s easy to see if your orders are well placed relative to current liquidity in the orderbook.

Market Playback

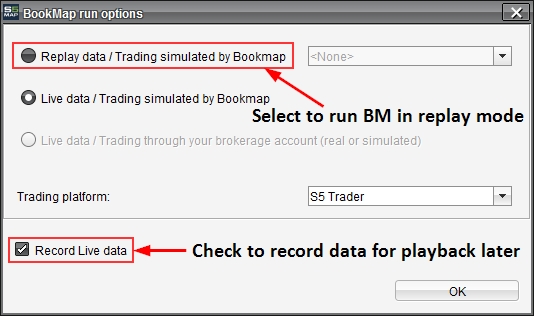

If you’ve used Linnsoft IRT, Market Delta or Sierra Chart extensively, you’ll probably at the very least, come across their market playback functionality. Futurestrader71 is a big advocate of using playback as a method of getting in sync with the markets, especially after a week or so of not trading.

BookMap also has the ability to playback market data once it’s been recorded.

In the latest version (I’m using 4.3.0 beta 101), you have the option to playback data at various steps between 1/8x and 128x.

The one big problem with this is that it doesn’t currently have a way of rewinding or skipping forward like you’d see on a video player. This would be a HUGE improvement to the feature.

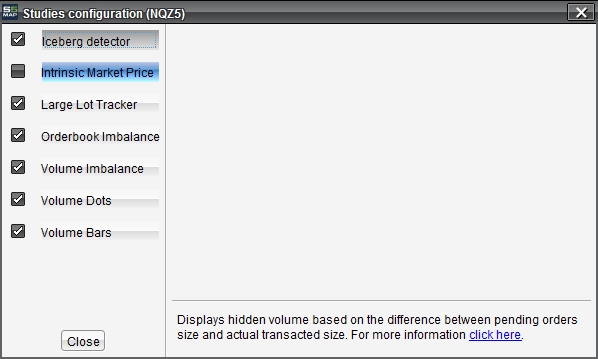

Add-on Studies

There are various other studies which may or may not be especially useful to you depending on your strategy. They are as follows (Iceberg, Large Lot Tracker and Imbalance are paid add-ons): –

Hand tool

This tool is way, way more useful than I initially realised. What it basically does is allow you to scroll the chart back. Whilst it might have been easier to just add a scroll bar for this functionality, the best part of the hand tool more than makes up for its slightly awkward implementation.

What happens when you scroll back is that not only do you see the historical orderbook, but you also see exactly what your info columns were at that moment in time. So you’d see what the session volume profile was up to that point for example. You’d also see exactly what the orderbook was at that time. So it’s incredibly fast and easy to go back and see how a market behaved if you missed it at the time. Very nice indeed!

Tooltip

The tooltip tool is just a far easier way of viewing the orderbook and trade info of a particular pixel. Before it was a feature, you’d have to hover over the pixel, keep your mouse steady and then look to the info bar at the bottom of the map.

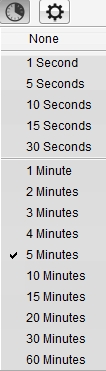

Time Slices

This feature allows you to quickly select a few different timeframes for the entire map to display (not time per pixel).

It’s pretty useful as it allows you to switch between views quickly. The problem comes however, when you have volume dots configured for a specific view. You might want to have them set to display a higher minimum pixel volume when zoomed out than when you’re zoomed in.

There doesn’t seem to be an easy way around this. You can’t even open more than one map of the same instrument in the version that I’m reviewing. Still, this software is constantly evolving.

Datafeed Connectivity

In terms of datafeed requirements, you have several options. S5 Trader, which is an OEC (now Futures Online) white label, is able to connect and S5 do have exclusive rights for this feed at the moment. You can also connect via CQG, DTN IQFeed (you’ll need level 2 data though), TT X-Trader Pro, NinjaTrader and Interactive Brokers.

One word of warning though – you can’t currently use it with any supported feed if like many traders, you have more than one of the ones they support. You can swap feeds, but you must contact them in order to change this rather than being able to switch between feeds yourself (as far as I know).

One other point about data is that they don’t support historical data even if you save your data as historical. This might not seem like much of an issue, but when the program crashes (although it’s generally very stable) or more likely Windows or Java crash (which BM runs on), you lose all your live session data and must start the data file again. So even though you’ve been running and recording BookMap, you’ll not see initially anything on your maps when you restart the software.

BookMap Reviewed

There are bits and pieces that could have probably be done a little bit better and I’m sure new useful features will come in the future too. The one other issue that I’ve not mentioned yet is that the colour settings leave something to be desired. Although there are several options, there aren’t enough for the bid and ask colours. If you want a different colour profile to your bid/ask lines for example, you’re out of luck.

That said, the guys at VeloxPro are very responsive and they are constantly working to improve their software. They should be extremely proud of what they’ve achieved so far.

BookMap X-Ray is a cutting edge trading tool and although there is established orderflow software competition in the form of IRT (with the new “Trail of Intentions” feature), Jigsaw Trading, Market Delta (footprint) and Sierra Chart (numbers bars), this is in my opinion the one to watch.

It’s a very cool bit of software and I’d go as far as saying that it’s a game changer.

BookMap’s pricing model has now changed. They now charge $49 per month for BookMap Basic and $99 per month for BookMap Advanced (BM Basic + add-ons) both billed quarterly.

Good review.

I see it as a complement to the other parts of your order flow arsenal, not a complete replacement.

Do you have any views on using Bookmap on currency futures, which are dependent to a large degree on the forex market ? I think Bookmap has to be used slightly differently there

Thanks mate! Yeah it’s got to be a complimentary tool right now, but that could change in the future from some of the changes/additions they’ll be making to the software.

Currency futures are an interesting one. I’ve looked at the orderbook and the way it’s set up generally (more heavy on alternate prices) kind of masks things a bit. I had suggested to VeloxPro to think about allowing multiple prices per line to help with this – the same thing could possibly help with thinner products too.

Either way, I’m not 100% on the orderflow on the Euro Futures for example, as I see them as being much more dependent on cash. Still, it’s something I’d have to fully investigate to have a good idea of what’s going on.

Thanks for replying.

I have to say the updates in v4.4 have surprised me in a good way.

I can now foresee that I will do all my order entries via Bookmap although for the time being I will have a Bookmap “cheat sheet” printed out in front of me as it is too easy by far to press the wrong button when entering or modifying orders via Bookmap.

I think the only things they need to address urgently are:

1. Shortcut keys or toolbar buttons to reset the current trades column

2. A way of rewinding during market replay

3. Some form of drawing tool so eg you can highlight what looks like resting paper

No worries MR.

I think that 4.4 definitely shows they are moving in the right direction.

I’d still prefer to see the orders on the map but edit them from a DOM at the moment as 1) prices can still move as you try to click and 2) I find the DOM on S5 Trader (and other platforms) easier on the eye, especially over longer sessions. In terms of clicking the wrong button – yeah not good and it only takes 1 mistake at the wrong moment to cost you a lot of money – I prefer DOMs with separate buy and sell columns to prevent this issue.

They are making strides towards improving their trading interface but one thing to consider is any implications of the TT patents, which I know newer software companies are loathed to pay for.

Rewind (and a scroll bar) on the replay function is definitely something I’d like to see. A different option to a drawing tool which I have already suggested to them, is the ability to extend high resting volume areas to the current time (possibly by colour). I know that they have considered a variety of more traditional charting features but I’m not sure whether or not they are currently planning to go ahead with any and when that might be.

In either case, BookMap is getter better all the time 🙂

TR,

What are your thoughts on Jigsaw v5.3 and their auction vista heatmap.

I must admit, as a paid customer of both Jigsaw and Bookmap, I’m a little confused on the way forward.

I have found in the past that Jigsaw is the best DOM around and I like the recon tape and iceberg alerts a lot.

However, having spent a considerable amount of time with Bookmap over the last few months and begun to understand how to use certain features such as the auto reset in CQC I don’t want to put that learning to waste.

Will you personally stay exclusively with Bookmap or do you use certain Jigsaw features as well and what do you think of their implementation of the heatmap.

Thanks

Hey MR. I have looked at it and I think it’s a poor shadow of BM at this point in time. That’s not to say things won’t change in the future.

Execution is still not completely to my liking on BM but things are starting to change on that front. I’d also like to see a fixable price scale.

BM is a new and fast evolving product and early adopters are bound to see areas of improvement. But the rate at which these improvements are coming is probably a little worrying for some of the other software vendors out there!

Hi,

I think they are both improving rapidly now.

The problem I find is that the BM ladder is not user friendly at all.

I have been testing out the latest iterations of Jigsaw in MC.NET and I am extremely impressed, especially since I started looking at a thinner market (NQ) and since I started using the Rithmic datafeed.

It’s probably a personal choice but I think as at today’s date I find the Jigsaw combination to be more useful.

I find BM to be really good for market replay or just going back in time say fifteen minutes when analysing live during an interesting session.

So what that means for me is I have Jigsaw on my screen and BM (one market) minimised and brought up from time to time if say I want to see what the previous cluster of dots at this location looked like.

PS you were right that 6E is not really that suited to day trading

I still feel that it’s better to gauge orderflow in general and as such I would watch it over a standard DOM – remember that there’s no history on a standard DOM.

The current issue is with execution imo, but again, that is already beginning to change.

Watch this space 🙂

Assuming there have been some updates to BM since this review. How are you finding it now?

Hi Nic. Sorry for the delay in my response. There have been some useful additions to BookMap since the full review. I have been told however, that there some exciting imminent features coming to the next version. When this becomes available, I will post my thoughts!

5.0 is out–thoughts?

All I can say Lou, is that BookMap is getting better and better all the time.

thnx for such article.

bookmap is the real thing u need.

it is just a TRUE data visualization that will change your perspective to how u look into markets/orders/liquidity/volume/price action.

the only product i tried that deserve every penny u pay for it.

nothing will be better: go for it.

omran

Been trading for over 5 years and came across pretty much every platform out there which only disappointed me. None of these gave me the source level information that mattered. Signed up for BookMap couple of months ago, got well versed with it and trading live account.Such a joy doing the work these days,best conviction I have behind my trades ever.Gone are days of doubt, hesitation and fear which were result of lagging information from what I call surface level information coming out of so called”industry best” charting packages.

Great work Bruce and Team…

After using BookMap for about six months (now v6.0), I am even more convinced that it is the single most distinctive, useful and seamlessly elegant trading software product I have ever come across. Its ability to transform extremely complex, at times seemingly chaotic, information into an elegantly simple and compelling visual format reminds me of Charles Minard’s famous 1869 graphic of Napoleon’s disastrous Russian campaign. In addition, I found Veloxpro to be quickly responsive to questions and suggestions for enhancements, which are encouraged. They conscientiously maintain and update their product. Although I still use candlestick charts, derive my levels with Market and Volume Profile and monitor correlated markets and market internals, I’ve switched from executing on a DOM and managing on a footprint chart to doing all that on BookMap. It’s that good.

Visual innovations like BookMap’s, are absolutely key to quickly interpreting data. The human mind is in general, very well adapted to visual pattern recognition (think about our ability to recognise faces for example) and this can serve a day trader very well. Adding other more widely used studies such as VP and T&S, BookMap does a great job in bringing decision making tools together. That said, it doesn’t provide the same sort of big picture analysis that a charting package such as IRT, Sierra or MD can, so it shouldn’t be considered as a complete solution in my opinion (at least as of version 6.1). Either way, the power of seeing the historical orderbook in all its glory and how the market traded relative to that, is golden. Just think about how prop shop traders and floor traders before them, had to remember the book and where certain trades were executed. MarketDelta went some way towards helping this, BookMap goes even further.

Hi TradeRunner,

Thank you for this Bookmap review. However now it is more than 3 years old.

It would be an excellent exercise comparing the features available back in 2015 and now in 2019.

Hey Carl,

Yeah I appreciate that. There are some exciting new features that the Bookmap team are aiming to release in the near future and that might be a good opportunity to revisit this. All I’d say is that for those thinking about whether to go with BM or not, they’ve added lots of new features since this review. E.g. trading DOM, CloudNotes (load levels from a server), api for plugins etc.